Understanding the difference between Payment Links vs Anytime Payment Link

Choosing the Right Payment Collection Method: Payment Links and Anytime Payment Link Explained

The AndDone Payments Portal provides two distinct ways to request and collect payments: Payment Links and the Anytime Payment Link. Understanding the difference between these options helps you select the most efficient and secure method for your business and your clients.

This article explains how each link type functions, their unique benefits, and includes resources for step-by-step instructions.

Payment Links

What is a Payment Link?

A Payment Link is a unique, client-specific URL created for an individual transaction.

When generating a Payment Link, you (the merchant) will need to prefill important payment details ahead of time, such as: - Payment amount, Purpose of payment, Reference (e.g., invoice or account number)

Once your client completes the payment the link cannot be reused. This adds an additional layer of security and streamlines your receivables process.

When to Use a Payment Link?

Use Payment Links when you need to request a payment for a specific invoice, policy, or account, and want to control the information (like amount & reference) provided on the payment link for your client.

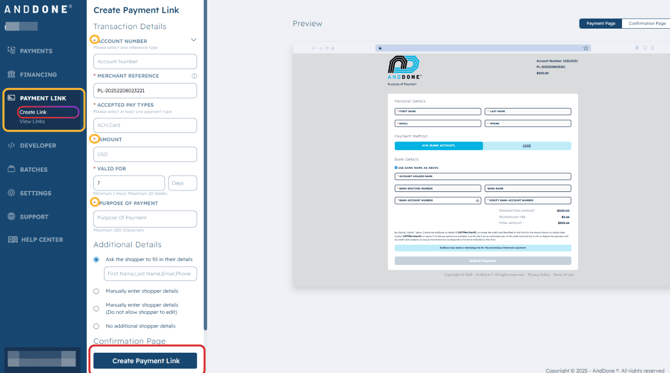

Where is it & how-to guide: See image below & click here to learn how to: Create a Payment Link

Anytime Payment Link

What is an Anytime Payment Link?

Unlike Payment Links, the Anytime Payment Link is a persistent, static URL that does not change and is always available. This link can be given to clients at any time, allowing them to make payments as needed.

When client (your shopper) receive an Anytime Payment link they will need to manually enter the payment amount, and provide a reference, such as a policy number, account number, or invoice number.

When to Use:

Share your Anytime Payment Link when you want to give clients an always-available option for making payments – for example, from your website, your email signature, or recurring correspondence.

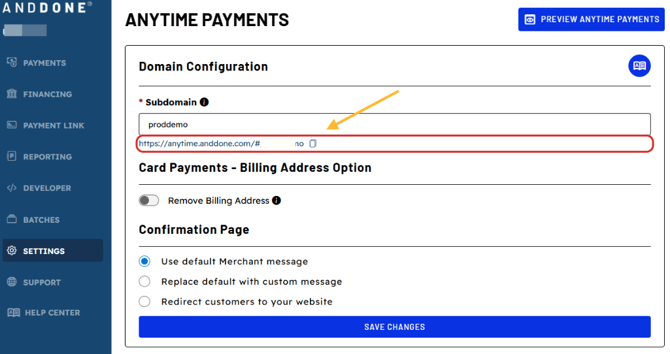

Where is it & how-to guide: See images below & click here to learn how to Access the Anytime Payments Link

By leveraging both Payment Links and the Anytime Payment Link, you can provide secure, streamlined, and flexible payment experiences for every client scenario.

Related Articles:

If you need assistance or have any further questions, please click here to contact our support team.